Three key reasons for why it takes time for tariffs to show up in inflation data:

- Contracts with input suppliers — manufacturers have contracts with input suppliers or hedges that prevent them from immediately experiencing a rise in input costs. This rise will come when contracts renew or hedges expire.

- Contracts with retailers — manufacturers have contracts with retailers that prevent them from passing on higher prices. But they’ll pass on higher prices when contracts come up for renewal.

- One bite at the apple — manufacturers are waiting for more certainty on tariff levels before raising prices. They can’t keep changing prices with their retail partners. They want to know where tariffs will land before they increase their prices. In the short run, they’re willing to absorb higher tariff costs before passing these on to consumers if it means getting the price increase right when the time comes.

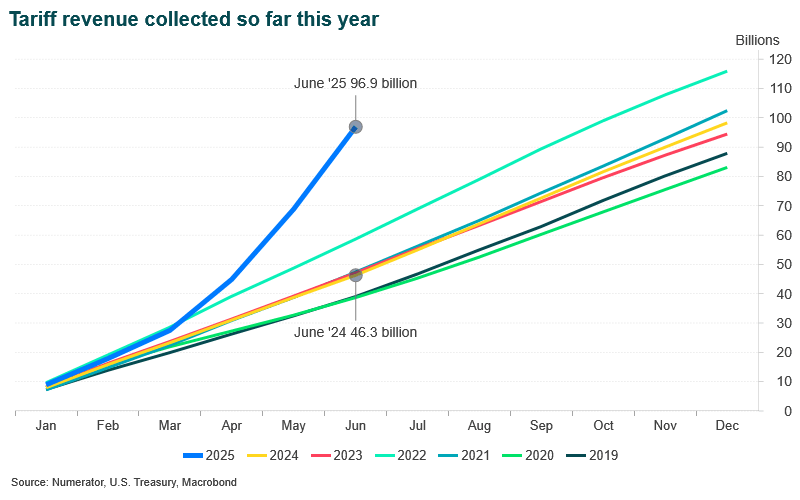

We are, in fact, seeing much higher tariff revenue coming into the US Treasury.

- $50 billion more in tariff revenue so far this year, divide this by 132 million households in the US, and that’s an additional $375, on average, that US households are paying so far this year (or will be paying, once these costs are passed on to them).

- We are barely starting to see these higher tariff costs showing up in the CPI. In today’s CPI, we saw some of the largest month-on-month increases in items affected by tariffs: appliances, linens, certain apparel items, watches, sporting goods, toys. It’s still early days, but it looks like we might only be able to have two dolls after all.

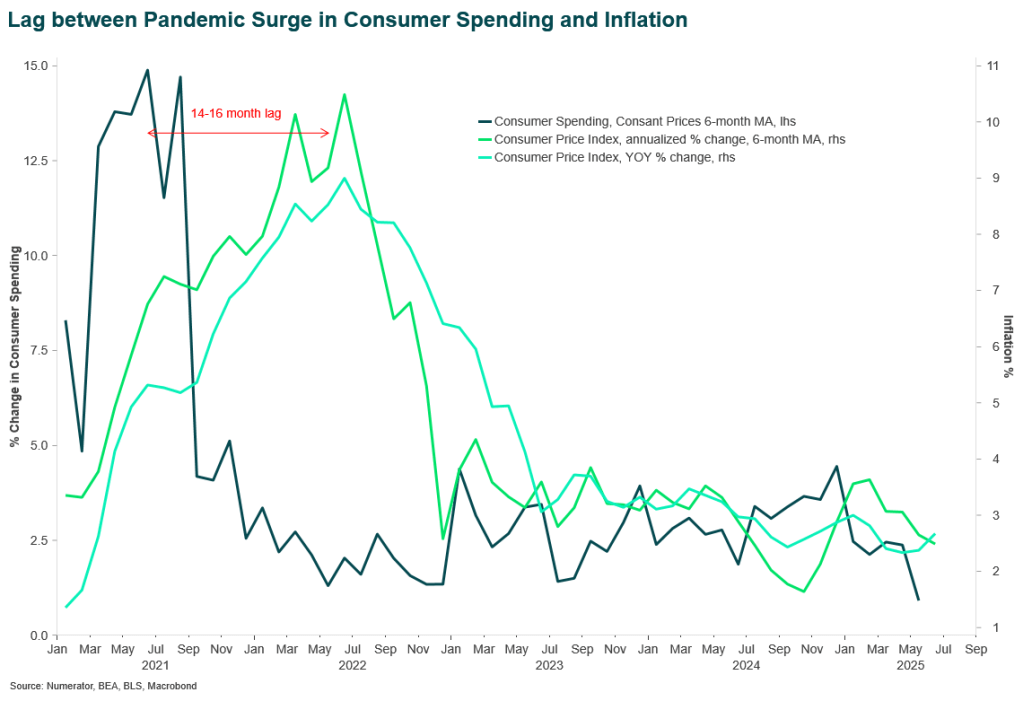

Keep in mind that following the pandemic reopening in March 2021, it took 14-16 months between the surge in consumer spending and the peak in inflation, in June 2022. It takes time for a shock — like a surge in consumer spending or tariffs — to work its way into inflation.